Overview

Create alternative economies where working-class communities don’t rely on extractive brands. Transparent income for drivers (100% of delivery fees) & service fees for platform access; viable logistics for restaurants, without VC extraction.

Functional dispatch platform, Spanish-first interface, community-driven logistics. Named after the Purépecha word for “rabbit” (agility, intelligence, ancestral wisdom). Brand colors reflect Michoacán avocado hues, cultural and economic pride.

Savior brand, moralizing platform, cheap gimmick, VC-driven growth machine, commission-based extractor.

The Challenge & Mission

Simultaneous US (DMV) and Mexico rollout with Spanish-first interface. Courier service in Uruapan, Michoacán + dispatch in Ecatepec/Mexico City.

Regulatory barriers, partnerships, and operational issues forced Mexico’s postponement. Technical challenges in payments, distance calculations, and APIs required a single-market focus.

DMV-only launch (MD/DC/VA) to validate model. Mexico is ready but paused. Soft launched Nov 15, 2025. First paid trip completed.

- Currency: USD/MXN

- Metrics: Miles/km

- i18n: Spanish UI/English admin

- Security: Fixed double-submit

- Google Maps APIs: Business names + addresses

- Firewall: Resolved AJAX blocks from POST method

Product Strategy

Market Priority

- Drivers left with WhatsApp chaos if they avoid big apps

- No unified dispatch, unstable demand, paying $130-150 weekly for access

- AUANI gives structure without extraction-transparent pricing, job autonomy

- Status: Manual onboarding, active fleet in DMV, Shipday dispatch live

- Onboard once driver fleet reliable

- WCFM multivendor portal ready for self-service menu management

- 30-40% commission on big apps = unsustainable

- Status: Live with v3.2.0! Includes food delivery and pickup checkout wizards, Stripe integration for payments, and automated order submission to the Shipday API.

- Working-class, practical decision-making-99% mobile users

- Minimal loyalty-driven by price and speed

- 4-step wizard form optimized for mobile-first experience

- Status: Live in production; first paid trip completed November 2025

Research & Insights

Finding: 99% of users are on mobile devices. Long single-page forms created friction.

Method: User testing, form analytics, mobile behavior patterns.

Impact: Rebuilt as a 4-step wizard form with progress indicator, back navigation, step validation. Smooth transitions optimized for touchscreen.

Finding: Manual onboarding and WhatsApp groups build trust faster than digital-only in working-class markets.

Method: Ethnographic fieldwork, driver interviews, and community engagement.

Impact: Temporary manual driver onboarding during launch. WhatsApp Business API integration is deferred until the driver network is stable.

Finding: Users don’t always know street addresses-they say “pick up at Starbucks” or “drop off at Walmart.”

Method: Form submission analysis, user testing, Google Places API types configuration.

Impact: Fixed autocomplete to accept both addresses AND business names/POIs. Country restrictions prevent international suggestions.

Finding: Working-class clients prioritize clarity over complexity. Hidden fees create distrust.

Method: Pricing display testing, user feedback, competitive analysis.

Impact: Price breakdown shows delivery fee (driver) separate from platform fee (AUANI). Desktop color contrast fixed for visibility.

Decision Framework

| Decision | Considerations | Action | Rationale |

| Market | Multi-city Mexico vs. Single US market | DMV-only | Reduce operational complexity, validate model in controllable environment |

| Priorities | Launch both rideshare + delivery vs. Sequential | Rideshare first | Build driver supply before adding restaurant complexity |

| Tech | Custom build vs. API integrations | Hybrid (Shipday API + custom) | Speed to market without sacrificing control |

| Language | English vs. Spanish vs. Bilingual | Spanish UI, English backend | Match end-user needs while maintaining operational efficiency |

| Growth Model | VC funding vs. Bootstrapped | Bootstrapped | Maintain non-extractive model, avoid growth-at-all-costs pressure |

UX & Design

Personas

Motivations: Predictable income, autonomy, alternatives to extractive apps

Barriers: WhatsApp chaos, inconsistent gigs, lack of unified dispatch

Opportunity: AUANI provides structure without extraction; reliable demand, transparent pricing

Motivations: Reliable delivery, clarity in pricing, sustainable margins

Barriers: 30–40% commissions on big apps, opaque fee structures

Opportunity: AUANI offers transparent, lower commissions with direct restaurant relationships

Motivations: Affordability, speed, convenience

Reality: Minimal loyalty-will use whatever platform works and is cheapest

Opportunity: AUANI competes on price and reliability, not brand affinity

Key User Flow Journeys

- Discovery: WhatsApp groups, word-of-mouth, community referral, Facebook Marketplace, TikTok

- Manual Onboarding: Phone call or in-person meeting, explain fee structure

- Shipday Setup: Driver app download, account configuration, and test order only after they’ve reviewed the platform market guidelines

- Accept First Order: Shipday push notification, driver accepts, navigates to pickup

- Complete Delivery: Mark complete in Shipday; customer receives tracking link

- Receive Payment: Customer pays via CashApp/Venmo/Zelle/cash, driver gets 100%

- Partnership Outreach: Direct restaurant contact, pitch transparent fee model

- WCFM Portal Setup: Self-service merchant dashboard, menu upload capability

- Menu Configuration: Items, pricing, images, availability hours

- Test Orders: Internal testing before public launch

- Go Live: Customer orders via site, auto-dispatch to Shipday API payload

- Contact Info: Name, email, WhatsApp number

- Pickup Address: Google autocomplete (business names + addresses)

- Dropoff Address: Google autocomplete with country restriction

- Review & Pay: Price breakdown: delivery fee + service fee, Stripe authorization

- Order Dispatch: Submitted to Shipday API payload, driver assigned, tracking link sent

Brand

Functional alternative. Non-extractive. Pragmatic. Spanish-first.

AUANI is not a lifestyle brand or a savior narrative. It’s a working system that respects working-class people’s economic realities.

The brand communicates context over blame, action over rhetoric, and Inteligencia Artesanal, the resourcefulness that built these communities in the first place through the repurposing of current and available technology.

Purépecha Origins

“Auani” comes from the Purépecha word for “rabbit”-representing agility, intelligence, and ancestral wisdom. The Purépecha people of Michoacán built sophisticated economies long before Spanish colonization.

Michoacán Avocado Colors

Brand colors reflect the hues of the Michoacán avocado, a symbol of cultural and economic pride. Green represents growth, resilience, and the region’s agricultural heritage.

Context Over Blame

We don’t moralize about extractive platforms. We acknowledge the system and offer an alternative.

Action Over Rhetoric

No manifesto. No virtue signaling. Just a working platform that pays drivers fairly.

Inteligencia Artesanal

The DIY resourcefulness of working-class communities is modular, adaptive, and honest.

Alternative Economics

This is an economic experiment. Can we build viable logistics without VC extraction?

- Direct: No euphemisms. Say what we mean.

- Realistic: Acknowledge constraints and trade-offs.

- Grounded: Talk to users like adults with economic agency.

- Spanish-first: Primary language for working-class Latino markets in US + Mexico.

- Not: Inspirational, corporate, apologetic, or moralizing.

Header Typography

Bebas Neue works for a rideshare brand because it’s bold, condensed, and instantly legible at speed. It signals movement, confidence, and modern utility; it’s exactly what matters on mobile screens, street signage, and in-car UI. The tall letterforms feel directional and urban, while the simplicity keeps the brand neutral, scalable, and language-agnostic across markets.

The logo wordmark is the profile of a rabbit in motion.

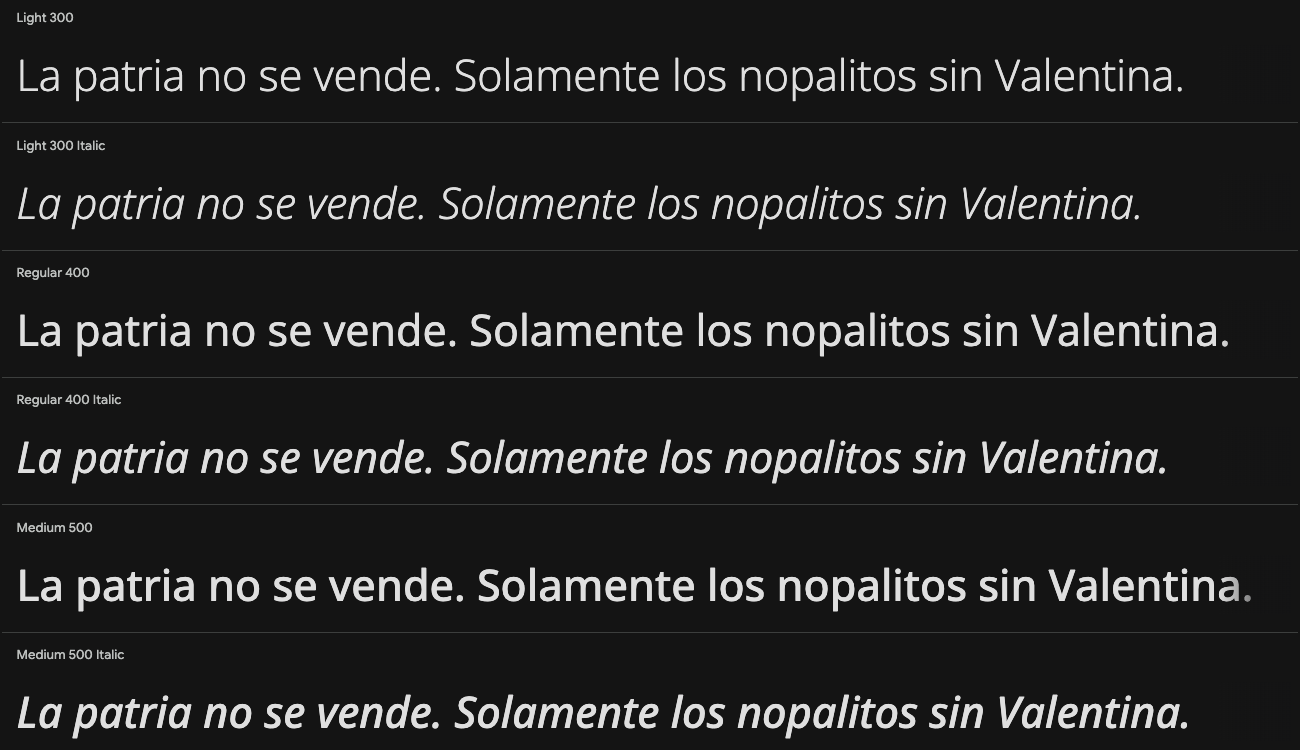

Body Typography

Open Sans works as a body typeface because it’s highly legible on small screens, forgiving at different weights, and optimized for long-form reading in apps. For a Spanish-first rideshare brand in US cities, it handles diacritics cleanly, keeps rhythm in longer words, and feels neutral rather than institutional. It supports trust, clarity, and accessibility across bilingual contexts without calling attention to itself.

Brand Colors

This color palette comes from the avocado itself; it’sa symbol of land, labor, and pride in Uruapan, Michoacán.

Together, these colors express a brand that honors Purépecha wisdom, centers artisanship, and uses technology as a tool, not as performative greenwashing. It shows up in the broader Hispanic community with respect, not extraction.

#f3fcf0

#9fcc2f

#295136

#0a0a0a

Marketing

Copywriting Principles

The primary audience is Spanish-speaking, working-class drivers & restaurant owners. All landing pages, forms, and communications are in Spanish. English is secondary.

Show all fees upfront. Explain how the platform works. No fine print tricks. If there’s a catch, say it.

Lead with numbers. Show exact costs, comparisons, and savings. Working-class audiences make practical economic decisions; respect that.

No corporate jargon. No tech startup hype. Direct, honest, peer-to-peer voice. “We,” not “our multivendor hybrid webapp platform.”

Engineering

- WordPress: CMS foundation

- WooCommerce: E-commerce engine

- WCFM: Vendor multivendor plugin

- WPMUDEV: Vendor site maintenance essentials

- Stripe: Payment processing, driver payouts

- Shipday API: Routing, dispatch, driver management

- Google Maps Platform: Geocoding, distance matrix

- WhatsApp Business API: On horizon (approval pending)

-

Why WordPress + WooCommerce: Familiar ecosystem for managing complex multi-sided marketplace. WooCommerce handles payments/orders out of the box. WCFM allows restaurant self-service menu management without custom admin builds.

-

Why Shipday: Avoid reinventing dispatch/routing logic. Focus energy on UX and economic model, not logistics algorithms. API integration gives control without operational overhead.

-

Why Stripe: Robust payment infrastructure with support for split payments (driver payouts), recurring billing potential, and Latino banking integrations (prepaid cards, remittances).

-

Why Custom Plugins: Core marketplace logic (driver onboarding, trip matching, payout schedules) requires custom WordPress plugin development. Not achievable with off-the-shelf solutions.

-

Why Spanish UI + English Backend: End users need native language. Admin/dev work is faster in English. WordPress allows clean separation via translation files.

auani-dispatch-manager/ # WordPress plugin root (v3.2.0)

├── auani.php # Main plugin file (v3.2.0)

├── includes/ # Core PHP classes

│ ├── class-auani-logger.php

│ ├── class-auani-utilities.php

│ ├── class-auani-pricing-calculator.php

│ ├── class-auani-pricing-display.php

│ ├── class-auani-customer-form.php

│ ├── class-auani-shipday-api.php

│ ├── class-auani-wcfm-integration.php

│ ├── class-auani-user-registration.php

│ │

│ ├── class-auani-food-delivery-checkout.php # NEW: Food Delivery Wizard

│ ├── class-auani-food-pickup-checkout.php # NEW: Food Pickup Wizard

│ ├── class-auani-debug-logger.php # NEW: Dedicated Debug Logger

│ │

│ └── stripe/ (conditional loading if enabled)

│ ├── class-auani-stripe-handler.php

│ ├── class-auani-order-payment-tracker.php

│ ├── class-auani-payment-interceptor.php

│ ├── class-auani-payment-cron.php

│ └── class-auani-shipday-webhook.php

│

├── assets/

│ ├── css/

│ │ ├── auani-frontend.css

│ │ ├── auani-stripe-frontend.css

│ │ ├── auani-wizard.css

│ │ └── auani-admin.css

│ │

│ └── js/

│ ├── auani-frontend.js # Google Maps autocomplete

│ ├── auani-wizard.js # 5-step form navigation

│ └── auani-stripe-frontend.js # Payment processing

│

├── admin/

│ └── class-auani-admin-settings.php

Economics

Competitive Comparison

| Platform | Payouts | Revenue | Model |

| AUANI | 100% of trip/order value | $3-$5 service fee (separate) | Service fee model, no commission |

|

Uber |

60-70% (commission taken from driver) | 30-40% commission from driver earnings | Commission-based extraction |

| UberEats | 60-70% (restaurant) | 30-40% commission from restaurant sales | Commission-based extraction |

Key Difference: AUANI does not reduce driver/restaurant earnings through commission. The service fee is a separate, transparent charge for platform access-not a percentage cut of what workers earn.

The Core Principle: Drivers Keep 100%

AUANI does not take commission from driver earnings. Drivers receive 100% of the trip fare they charge. The platform is funded by a separate service fee charged to customers for access to the dispatch system.

This is fundamentally different from Uber/Lyft, which take 30-40% commission from the driver’s earnings. AUANI’s model treats drivers as independent service providers who set their rates and keep what they earn.

Use Case Scenario

Driver receives: $12.00 (100% of trip fare)

AUANI receives: $3.00 (service fee, sometimes waived)

Note: Service fee covers platform operations, insurance, support. Driver payout is never reduced-even when service fee is waived, driver still gets $12.

Use Case Scenario

Restaurant receives: $25.00 (100% of order value)

Driver receives: $5.00 (100% of delivery fee)

AUANI receives $3.00 (service fee for online card payment processing)

Note: A $3-$5 service fee is charged to the restaurant for accepting online card payments. The driver keeps the full delivery fee. No commission taken from restaurant sales.

Artifacts